Polish cities in fDi’s European Cities and Regions of the Future - 2022/23 ranking

Among other things, fDi Intelligence deals with benchmarking – predicting where long-term investment is and will be profitable in Europe and globally.

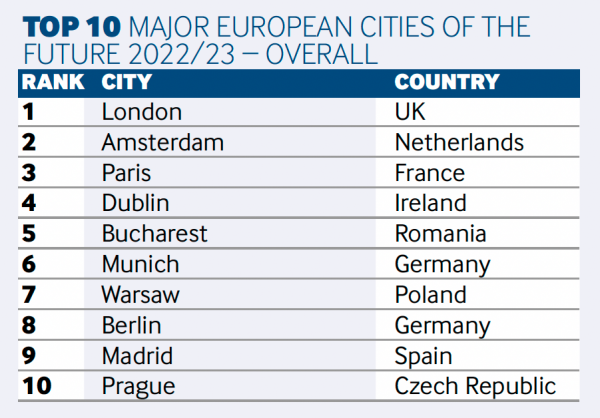

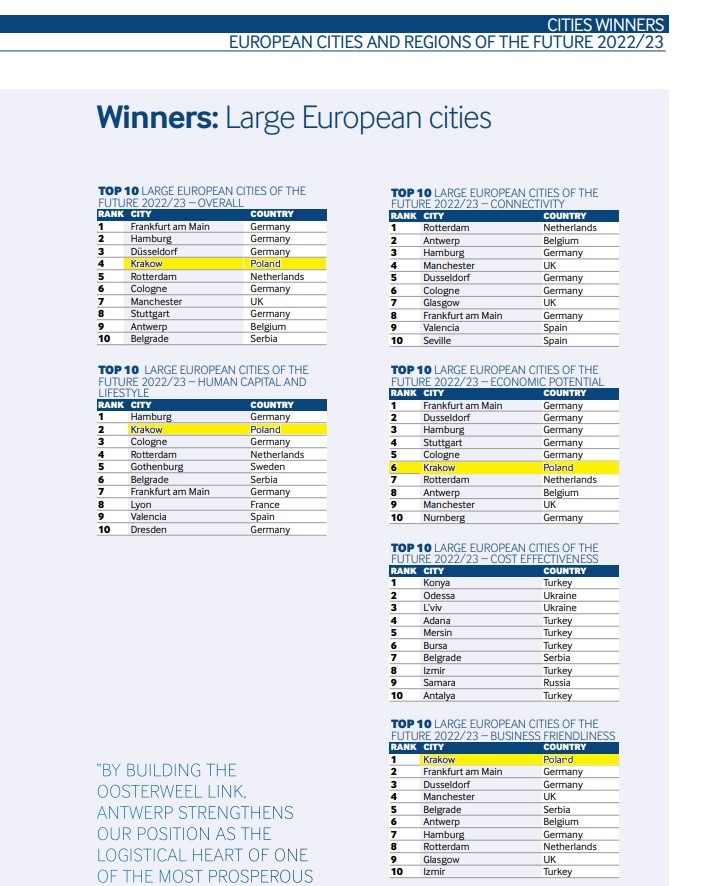

In their latest analysis titled European Cities and Regions of the Future 2022/23, a total of 356 European cities were audited, with as many as 14 representing Poland and reaching leading positions in the lists.

The results are divided into five categories: economic potential, human capital, cost effectiveness, connectivity and business friendliness. It is worth noting that the results of the research in each category are presented in such a way as to separate large cities (more than 250,000 inhabitants), mid-sized cities (100,000 to 250,000 inhabitants) and small cities (less than 100,000 inhabitants).

In the rankings, we can find the following cities: Warsaw, Krakow, Wroclaw, Poznan, Gdansk, Katowice, Lublin, Lodz, Bydgoszcz, Gdynia, Gliwice, Kutno, Strykow and Legnica.

Criteria

fDI experts take into account the number of universities, which translates into highly skilled workforce capable of addressing challenges in a modern and globalised labour market. An important factor are the cities’ marketing skills – the ability to advertise themselves and attract foreign investors. Innovation is also important – cities that focus on future technologies, IT, software developers, support for start-ups, that can attract and invest in young people with ideas, are high in the ranking.

Among the major European cities with the greatest economic potential, Warsaw takes a high 7th place in the overall ranking.

On the other hand, among large cities, Krakow turned out to be the most business friendly and to have the best human capital. Intellectual potential is also one of the key criteria for selecting congress destinations.

Katowice, Lublin, Gdynia, Poznan, Wroclaw and Bydgoszcz also appeared in the ranking.

Unfortunately, none of the Polish cities were in the top ten in the ‘cost effectiveness’ category.

Industries with future

When looking for a business client for a meeting or event, one should know the latest trends and industries that are developing best in the region (smart specialisations).

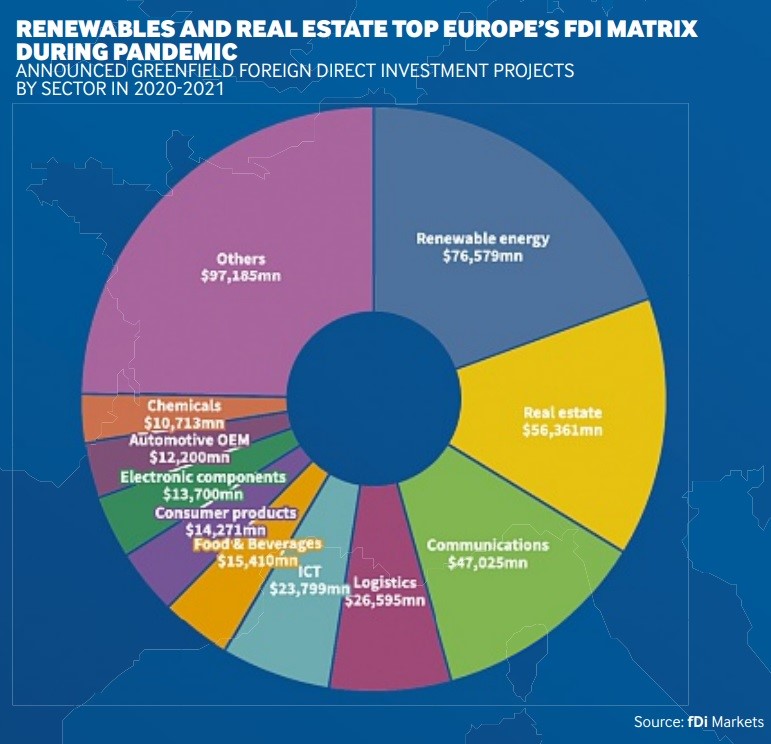

In 2020-2021, the Covid-19 pandemic had an impact on investments, but Europe was more resilient to it than the rest of the world. The Old Continent was the choice of nearly a half (46.6%) of business projects announced in 2020 and 2021; other investment-friendly regions were Asia-Pacific (19.86%) and North America (15%). This European resilience was built around 3 key sectors: renewable energy, electromobility and real estate.

The renewable energy sector (photovoltaics and wind) switched positions on the market with its main enemy, the sector of oil, coal and gas. The UK, Germany and Spain are Europe’s leaders in renewable energy, but the map of green investments is slowly expanding to include countries such as Poland, Greece and Romania.

The growth in electromobility observed almost everywhere in the world is crucial for achieving the climate balance. Europe is not an exception here, although many European countries, which are the main players in the global automotive industry, were implementing their e-mobility strategies very slowly up to a certain point. This approach was changed by the outbreak of the Covid-19 pandemic.

European capitals, notably Warsaw, saw record levels of investment in real estate in 2020 and 2021. At the country level, Poland was the most popular place for investors. Krakow and Poznan, apart from Warsaw, were the cities that attracted large foreign investments in this sector, including hotel investments (however, most of them being the result of investments started in previous years).

The last two years have been particularly difficult for city hotels, which are in a far worse situation than holiday facilities. Hotels in large cities are still awaiting the return of business guests and foreign tourists – although the situation has improved over the past months, and hotels are recording an increasing number of bookings, including increased interest from MICE customers. Hopefully, this trend will continue!

Source: Aneta Książek based on Report Foreign Direct Investment

Photos: Report Foreign Direct Investment